Market Volatility - Some Practical Advice

9th March 2020

|

You will, no doubt, have seen global stock markets fall heavily in the last few weeks due to concerns about the economic impact of the Coronavirus.

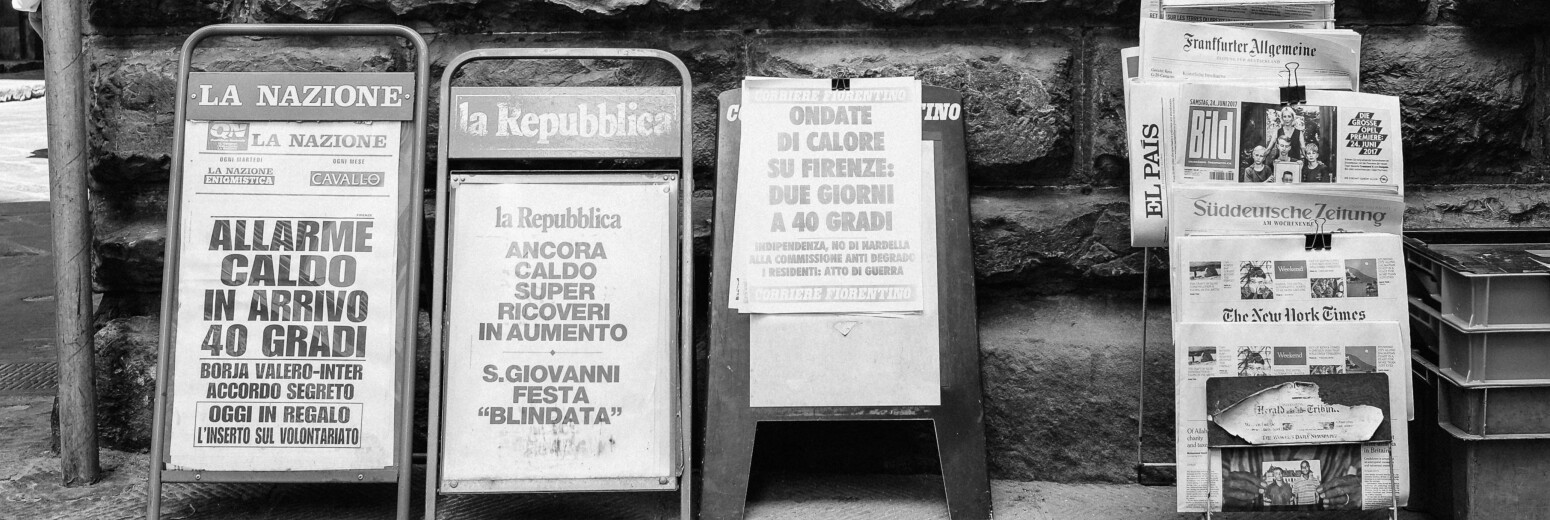

Whilst times like this can feel scary (and are exacerbated by media headlines) there are some key points to remember and some practical things you can do:

Key Points

- The headlines about market falls relate to indices such as the FTSE 100 index or the Dow Jones in the US. Depending on your risk category, your investment or pension will be invested more cautiously than this and certainly with greater diversity

- So, it is unlikely that your investment or pension will have fallen as much as you may think

- If your circumstances, time horizon and objectives have not changed, then our advice is to sit tight

- Markets have been subject to severe drops in the past (such as the 911 terrorist attacks in 2001 or the financial crisis in 2008) and no doubt will do so in the future, but history has shown us that they always recover

- Our view is that this is a short, sharp, shock as opposed to a longer term fundamental shift in global growth

Practical Action

- If you are making regular withdrawals from a pension or investment, if you are able, you could suspend or reduce these withdrawals for a period which prevents you selling units at a lower price

- If you are making monthly contributions to an investment or pension, it is vital to keep these going as you will be buying more units than before as prices have fallen and you will then be taking advantage of the market falls

- If you are sitting on a large amount of cash and are able to commit some of this for at least 5 years, now could be a great time to invest (rather than wait until markets have recovered) to take advantage of lower share prices

If you would like to talk any of this through with your adviser, please do not hesitate to get in touch and they can assess what is best for you.

Also, here are links to two very useful articles about market volatility:

https://professionals.fidelity.co.uk/static/uk-professional/media/pdf/volatility/when-doing-nothing-is-best.pdf

https://professionals.fidelity.co.uk/static/uk-professional/media/pdf/volatility/putting-time-on-your-side.pdf

So, the overriding message is not to panic, things are never quite as bad as they may appear and the patient investor is normally rewarded.

|

|

|

Posted

5 years ago

by

Chris Mallett

2 Minute(s) to read