Welcome to the Autumn 2017 Finance Shop Wealth Management (FSWM) Quarterly Review.

The aim of the Review is to give you a general feel for what’s happened in the financial world over the last three months and how this may have affected your pension or investment.

A key part of the reporting is the colour coding. Each FSWM portfolio is colour coded to enable you to spot which category applies to you. The relevant information is then presented in a clear and easy to understand way. However, if you require any further clarification, please do not hesitate to get in touch.

Market overview – Quarter Three 2017

The third quarter saw markets again post positive returns as dollar weakness aided emerging markets and reasonable growth numbers continued to keep a lid on volatility. Behind the scenes, however, the political situation continues to provide concerns led by the ramp up in hostilities between the US and North Korea. Thus far markets have remained remarkably sanguine, however should Kim Jung-un push the patience of the US too far, and China fail to step in, this could be the catalyst to provide some fireworks during the final quarter.

Perhaps of greater importance is the first tentative moves from the Federal Reserve in the US and the European Central Bank to begin reversing the quantitative easing programme which has seen trillions of dollars’ worth of bonds purchased every month across the globe. Whilst in many respects this is good news, as it supports the case that things have improved sufficiently for the emergency measures to be removed, it does also provide a less supportive back drop for markets.

As we progress into 2018 the ability of central banks to get the balance of removing stimulus at the right speed will have a big impact on the direction of markets, and it is difficult to see the subdued levels of volatility continuing indefinitely.

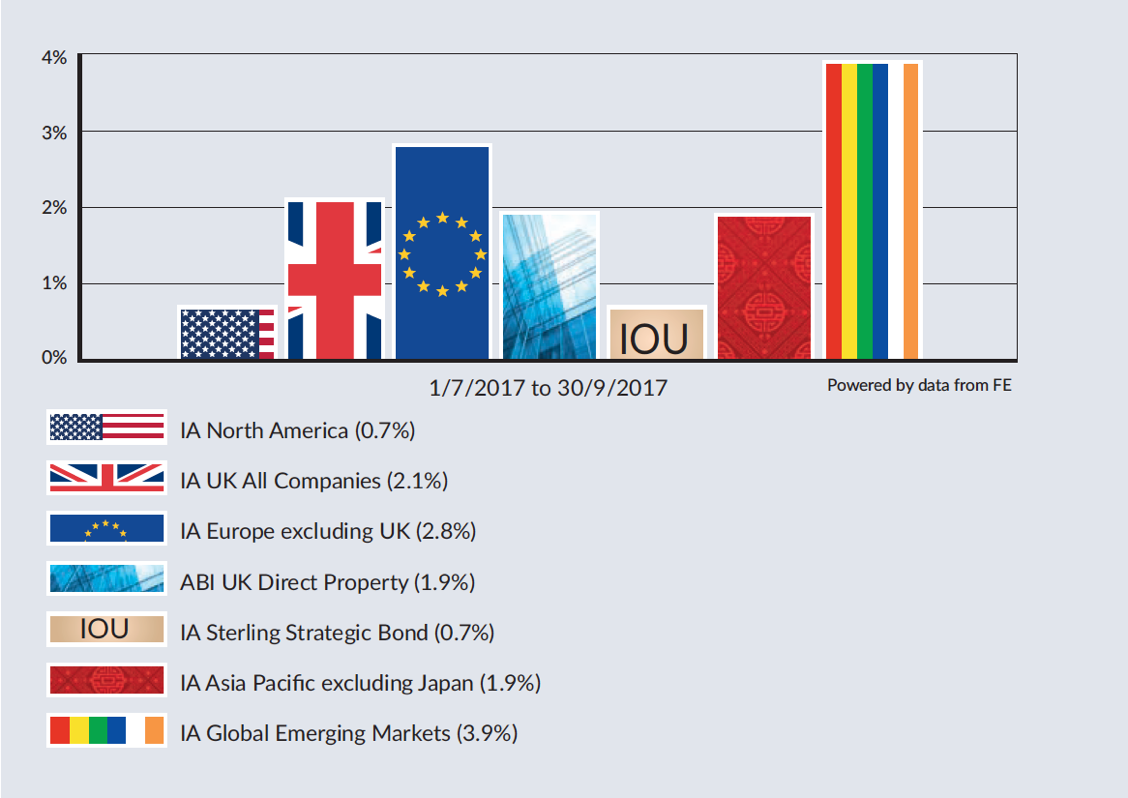

KEY MARKET PERFORMANCE - QUARTER THREE 2017

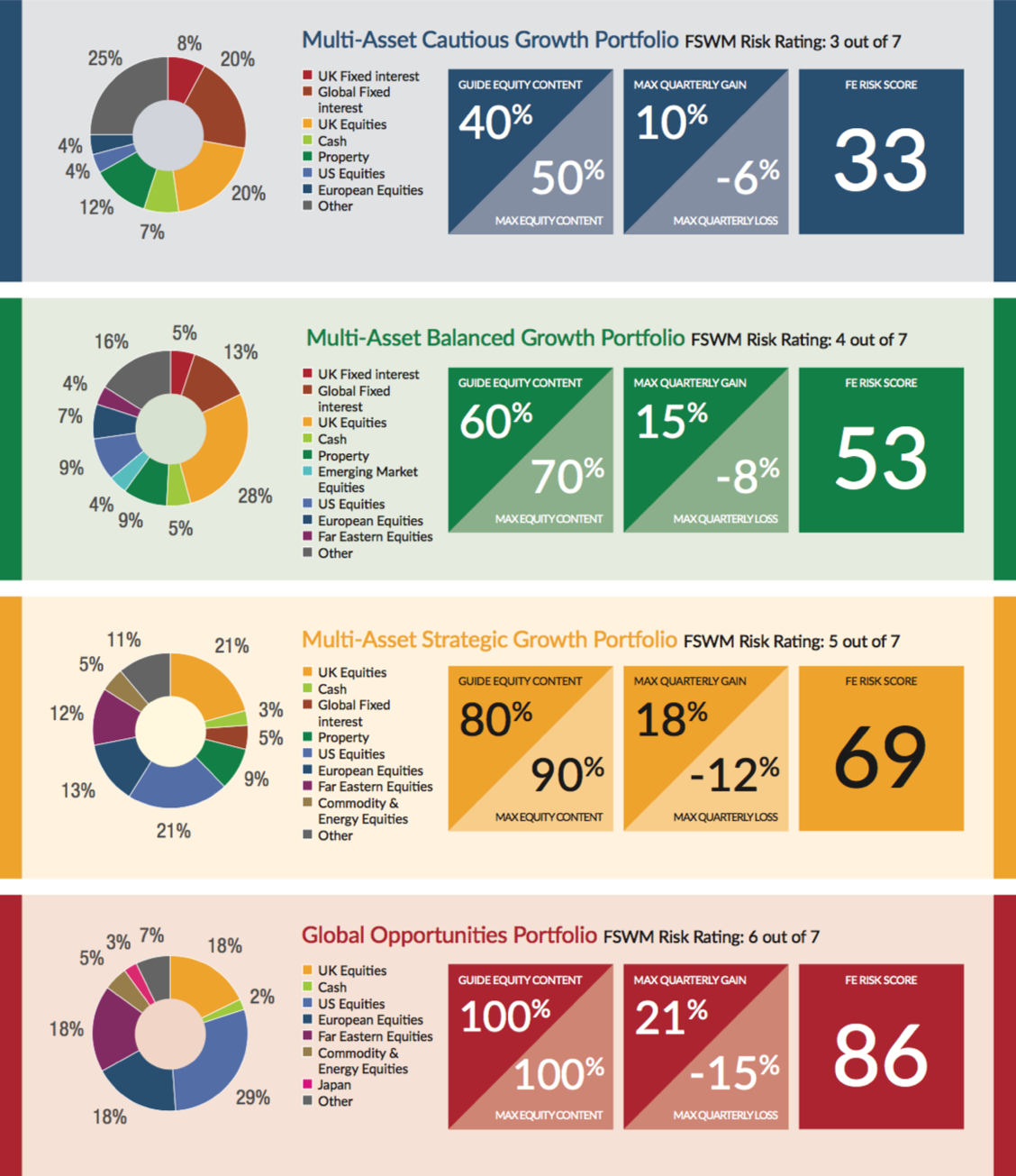

FSWM Portfolios – Asset Allocation

There are seven portfolios in the FSWM range, four Growth and three Income which are detailed below. Your FSWM pension or investment will be invested in one of these categories. The tables show the aggregate composition of the portfolios with some figures to show the potential risk and return of each category.

For an explanation of the figures and the sources of the information, please see Asset Allocation Tables – Important Information.

Growth Portfolios

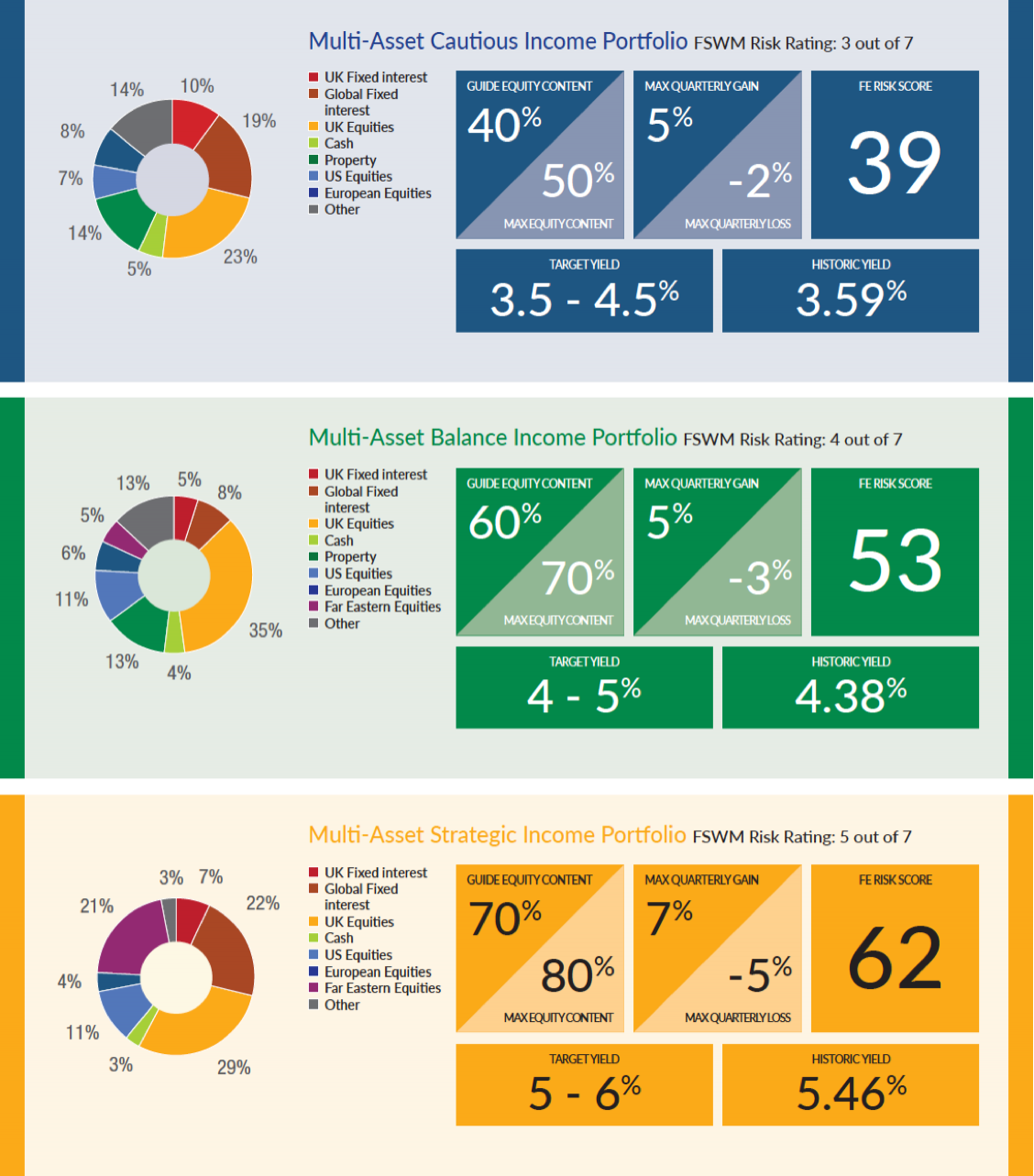

There are three income portfolios which aim to produce an income within a target range as highlighted in the table below. The three portfolios cover the Cautious, Balanced and Adventurous Finance Shop risk categories.

Please see Asset Allocation Tables – Important Information for further information.

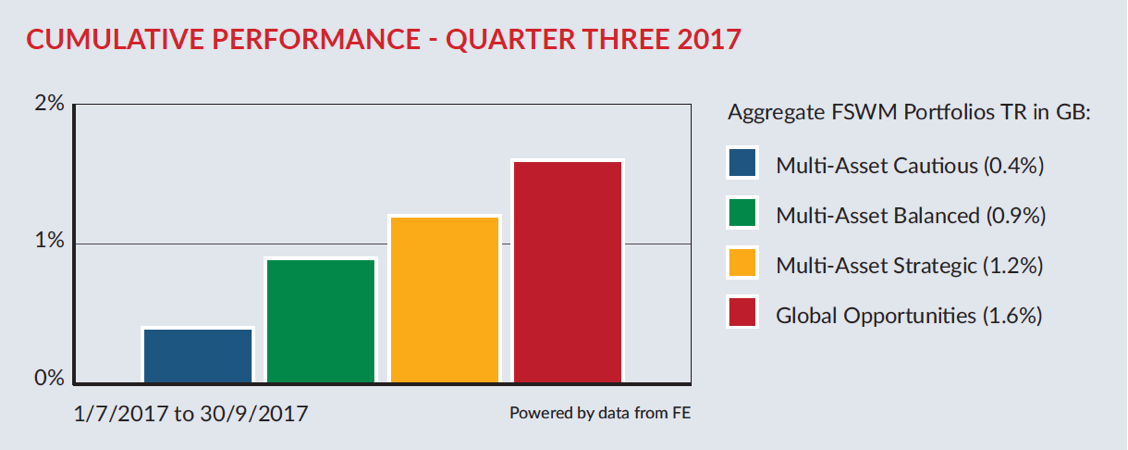

FSWM Portfolios – Quarter Three 2017 Performance

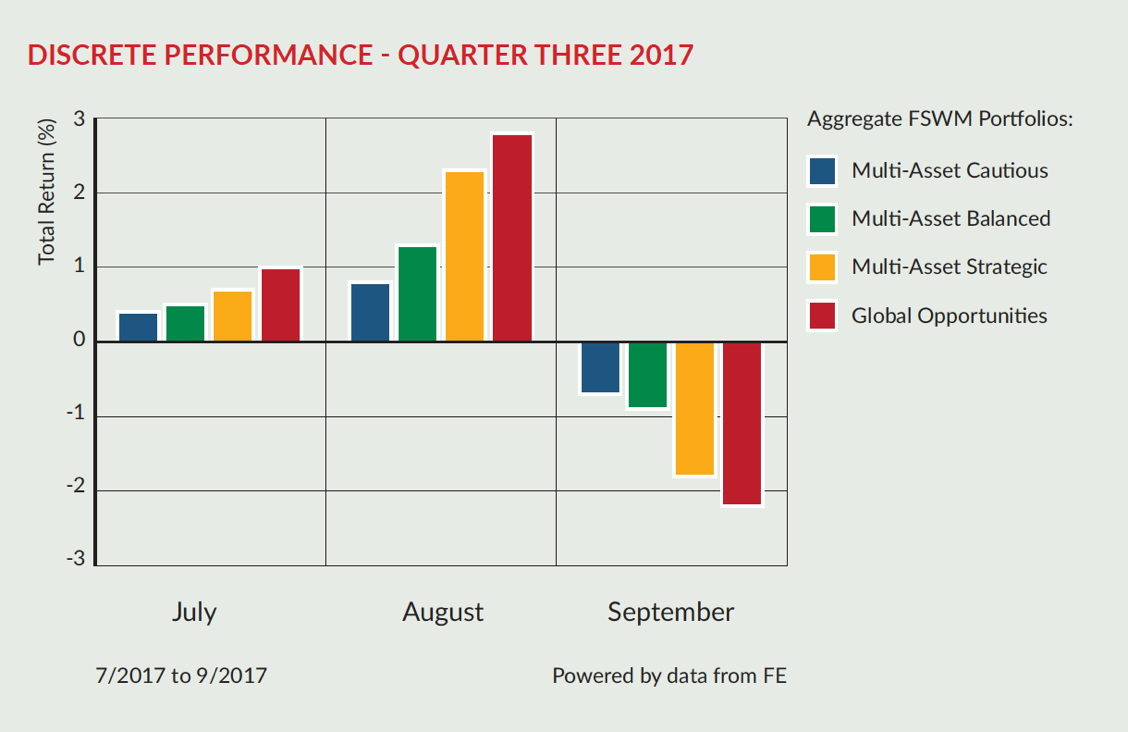

The graphs below show how the FSWM portfolios within the four Finance Shop risk categories have behaved over the last three months. The first graph shows the total return for the quarter whereas the second graph illustrates the “month by month” performance. The performance figures are aggregated so, for example, the green bar is made up of all the FSWM Multi-Asset Balanced portfolios across all product types. If you require specific performance figures for your plan, please contact your adviser.

FSWM Portfolios – Longer Term Performance

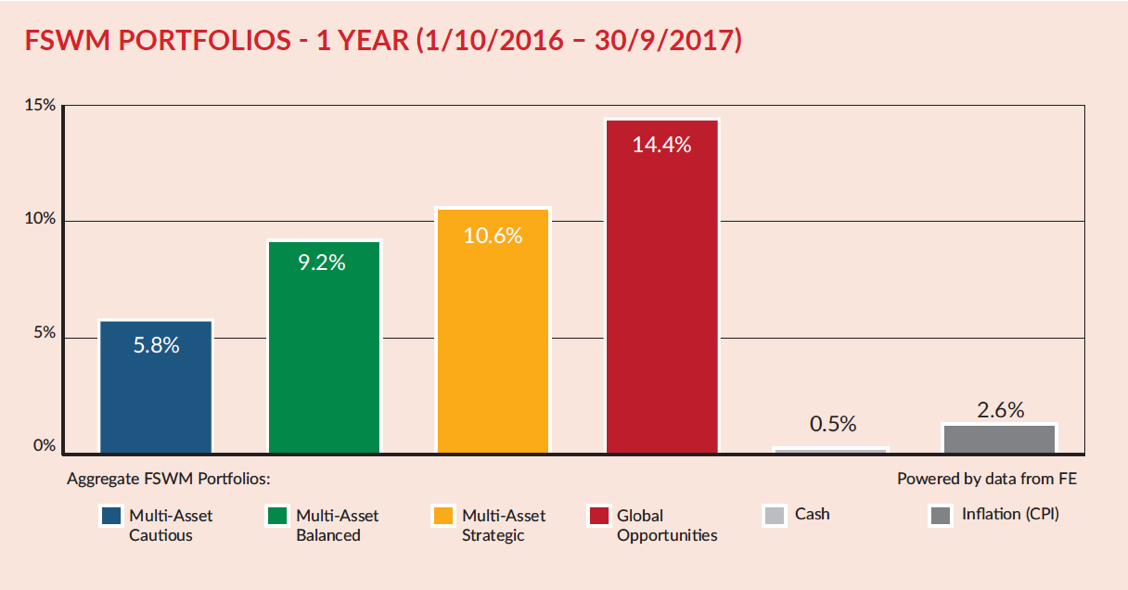

The first graph below shows how the FSWM portfolios have performed over 12 months. For comparison, the returns of cash (MoneyFacts 90 days notice 10K) and inflation (UK Consumer Price Index) are also shown. As with the graphs on page 6, the figures for each category are aggregated.

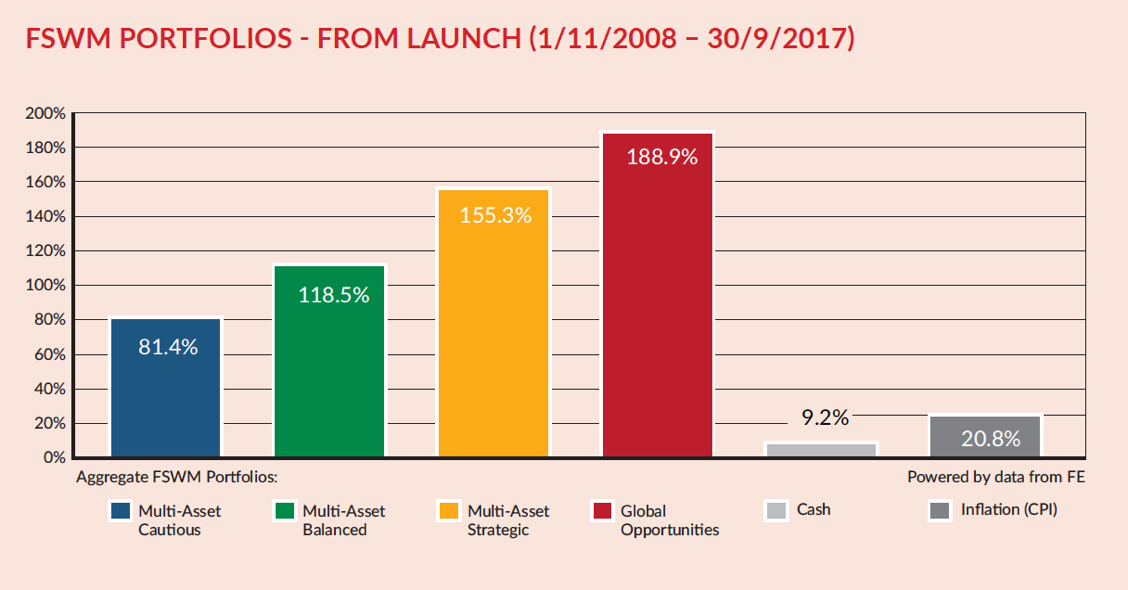

The second graph illustrates how the portfolios have performed since launch (1st November 2008).

Please see Asset Allocation Tables – Important Information for further information.

Performance Review

The third quarter again saw all of the portfolios deliver positive returns, with the more adventurous portfolios leading the way. Over the medium term, growth appears to be relatively stable with few signs of recessionary pressures which should continue to support assets. It may, however, prove to be a back drop where returns are a little more subdued.

FSWM Fund Review Policy

A key part of the FSWM service is to monitor the underlying performance of each fund within the portfolios for both risk and return. We have selected quality funds with strong track records and therefore do not envisage a high turnover of holdings. However, there will be occasions when the performance of an individual fund will lead to its expulsion from the portfolio(s). There are a number of factors that determine this decision, for example consistent under-performance, change of management team etc. It is also important, however, to have patience with a fund that is just suffering short-term under-performance.

We operate a “traffic light” system and will move a fund from a “green” to “amber” rating if the fund requires closer scrutiny at the next review. If a fund shows sufficient improvement, it will move back to “green”. If the fund consistently under-performs without good reason its status will change to “red” and the fund will be removed from the portfolio(s).

A replacement fund will be selected and all clients holding the fund within their portfolio will be notified. Upon receipt of their authority, the client’s funds will be switched accordingly.

Results Of Fund & Asset Allocation Review

The Investment Committee meets on a bi-monthly basis and one of its primary functions is to review our existing fund range. Within this meeting we scrutinise any funds which we feel are performing significantly differently to their peer group or benchmark, with a number then run against our internal performance and risk measurements.

No changes were deemed necessary, however the following funds remain under review:

- Henderson Multi-Manager Absolute Return

- Invesco Perpetual Distribution

- M&G Global Dividend

- Henderson Cautious Managed

- Neptune Global

- Invesco Perpetual UK Growth

- Jupiter European

- Newton Asian Income

Asset Allocation Tables – Important Information

The maximum quarterly gain and loss figures in the asset allocation tables on pages 4 & 5 are taken from Financial Express based on the last 34 quarters of the longest running FSWM portfolios (up to August 2017). For the table on page 5, the figures are based on 16 quarters.

FE Risk Score: Financial Express have introduced FE Risk Scores to provide a single, easy to understand measure of risk across a range of investments. In the UK, Risk Scores measure the riskiness of any given investment in relation to the FTSE 100. Weekly volatility is measured over up to 3 years, with recent behaviour counting more heavily than earlier behaviour. The Risk Score is calculated weekly, and can be tracked over time. Cash type investments will have scores near zero, investment funds will tend to have scores in the 0 - 150 range.

The FTSE 100 is always 100. There is no upper limit to the scores.

The asset allocation figures are aggregated based on the current holdings within the FSWM portfolios for a new investor as at 1st August 2017. They will vary on a daily basis subject to market fluctuations. Rebalancing will be recommended if equity content exceeds the benchmark maximums. There is no guarantee that any of the model portfolios above will achieve their stated objectives. Each model portfolio may also experience more or less volatility than expected. The value of investments will fall as well as rise and are not guaranteed. Past performance is no guide to future performance. The Finance Shop Risk Categories are graded from 1 to 7. The above portfolios cover categories 3 to 6. For further information on all categories, please speak to your Finance Shop Independent Financial Adviser.

Additional Important Information

This report has been issued by the Investment Committee of the Finance Shop Wealth Management team using data provided by Financial Express. Care has been taken to ensure that the information is correct but Financial Express and Finance Shop neither warrants, represents nor guarantees the contents of the information, nor does Financial Express or Finance Shop accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Currency fluctuations can also affect fund values. The above report does not constitute advice and you should speak to your Independent Financial Adviser before you make any alterations to investments or pension plans.

The instruments recorded above are weighted model portfolios created using Financial Express Analytics. Performance figures shown are based on the weighted models and may differ from the actual returns achieved by investors. Performance figures shown are based on bid to bid gross returns and do not include plan, contract or ongoing adviser charges / commission. Please refer to your policy documentation for further details.

Financial Express Limited Registration number: 2405213. Registered office: 7 Chertsey Road, Woking, Surrey, GU21 5AB. Telephone 01483 783 900. Website www.financialexpress.net

Finance Shop is a trading name of Finance Shop Limited. Company Number 07535053. Registered in England. Registered Office:

North Wood Place, Octagon Business Park, Little Plumstead, Norwich, Norfolk NR13 5FH.

Finance Shop is authorised and regulated by the Financial Conduct Authority. 10 – WEALTH MANAGEMENT QUARTERLY REVIEW AUTUMN 2017